Indicate the measures that have been taken since that time to assure this will not happen again.

The last two blogs talked about what subprime loans where and how they affected borrowers and a leader’s social responsibility. In this blog, I will discuss how lenders were regulated to prevent issues like this from happening in the future. The first thing that happened is that the public was made aware of this problem. This gave the borrower a chance to make smarter decisions on what they were intending to purchase. Banks where now restricted from proprietary trading and other forms of investments through The Volcker Rule which was called section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Schaefer, 2012). This was a very important action that took place Banks were notified through law that they could be regulated if they continued to my poor business and ethical decisions in the pursuit of financial gain. This law that was passed helped borrowers in the long run because it forced leaders to do the socially responsible thing and protect the borrowers from reckless loan purchases that they could not pay back with high interest rates. The next update to subprime loans will discuss an interesting notion that was explained in a paper written by Ernst, Bocian, and Li, 2008 who suggest ways that borrowers can protect themselves from loans with high interest rates, and what lenders could do to protect themselves from another crisis. According to Ernst et al., both parties should adjust their agreements to three things: 1. Eliminate yield spread premiums and prepayment penalties on subprime loans; 2. Strengthen accountability of lenders and investors; and 3. Establish fiduciary responsibilities for brokers. In my opinion, these things mentioned will help lower interest rates so that borrowers could maintain their monthly payments. These methods can help strengthen a lender’s brand by making them socially responsible through accountability of their actions. Most importantly, it is my opinion, that these methods could potentially bridge the gap between an ethical leader and his ethical decisions making that must be done in business.

Subprime CSR, Bad Loans…Baaad Loans

Ernst, K., Bocian, D., & Li, W. (2008). Steered wrong: Brokers, borrowers, and subprime loans. Center for Responsible Lending, 8.

Schaefer, S. (2012, April 19). Regulators: Banks have until July 2014 to comply with Volcker Rule we haven’t written yet. Forbes. Retrieved from http://www.forbes.com/sites/steveschaefer/2012/04/19/regulators-banks-have-until-2014-to-conform-to-unwritten-volcker-rule/

According to Gilbert, borrowers potentially lied on their applications, lenders and brokers were potentially inexperienced enough not to ask pertinent questions, or investors bought the collateral without understanding the details of the investment (Gilbert, 2011, pg. 91). There are many who disagree; however, the bailout of big businesses was a necessity that would prevent America’s economy from falling into another depression (Thiel, Bagadasarov, Harkrider, Johnson, & Mumford, 2012). This issue was wide spread. Even government employees, to include the military were threatened by a freeze on pay for service. The argument of what was fair or morally right is sometimes misplaced (Prager, 2013). The banks should have fallen in opinion, but America’s buying power and place as a super economy would have been next. What I have found through experience as a leader is that there has to be an acute distinction between ethical leadership and ethical decision making. According to Thiel et al., ethical decision makers are bound to identifying and responding to ethical issues or problems. The difference is that an ethical leader is perceived by his behavior. Where they relate is that an ethical leader must make decisions based off his character; or good decisions are made by ethical leaders. Because of this problem, thousands of layoffs and billions in write offs of assets happened since 2007. In my opinion, ethics was not as important as legally making a profit on high interest rates and fees paid by the borrowers.

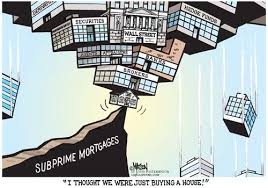

According to Gilbert, borrowers potentially lied on their applications, lenders and brokers were potentially inexperienced enough not to ask pertinent questions, or investors bought the collateral without understanding the details of the investment (Gilbert, 2011, pg. 91). There are many who disagree; however, the bailout of big businesses was a necessity that would prevent America’s economy from falling into another depression (Thiel, Bagadasarov, Harkrider, Johnson, & Mumford, 2012). This issue was wide spread. Even government employees, to include the military were threatened by a freeze on pay for service. The argument of what was fair or morally right is sometimes misplaced (Prager, 2013). The banks should have fallen in opinion, but America’s buying power and place as a super economy would have been next. What I have found through experience as a leader is that there has to be an acute distinction between ethical leadership and ethical decision making. According to Thiel et al., ethical decision makers are bound to identifying and responding to ethical issues or problems. The difference is that an ethical leader is perceived by his behavior. Where they relate is that an ethical leader must make decisions based off his character; or good decisions are made by ethical leaders. Because of this problem, thousands of layoffs and billions in write offs of assets happened since 2007. In my opinion, ethics was not as important as legally making a profit on high interest rates and fees paid by the borrowers. According to Thibodeaux (2008), this problem began in the 1990’s, however, the crisis was noted in the early 2000’s. So, what does this mean to the home owner or the borrower? Debt. The borrower would always be in debt. Another problem is that the same borrower could possibly lose their homes, cars, and be in more debt because they had to default on their loans (Watkins, 2011). The problem happened after in 2007, with a decline in mortgage lending, here lenders and brokers invested greatly in homes that they planned to sell through the subprime market to which no one was now buying. They had substantial loses and raised interest rates to tried and gain some financial loses back. The effects of subprime loans became a financial problem for all globally.

According to Thibodeaux (2008), this problem began in the 1990’s, however, the crisis was noted in the early 2000’s. So, what does this mean to the home owner or the borrower? Debt. The borrower would always be in debt. Another problem is that the same borrower could possibly lose their homes, cars, and be in more debt because they had to default on their loans (Watkins, 2011). The problem happened after in 2007, with a decline in mortgage lending, here lenders and brokers invested greatly in homes that they planned to sell through the subprime market to which no one was now buying. They had substantial loses and raised interest rates to tried and gain some financial loses back. The effects of subprime loans became a financial problem for all globally.